Empowering Your Investment Journey

Actionable Insights And Resources

Unlocking India’s Potential

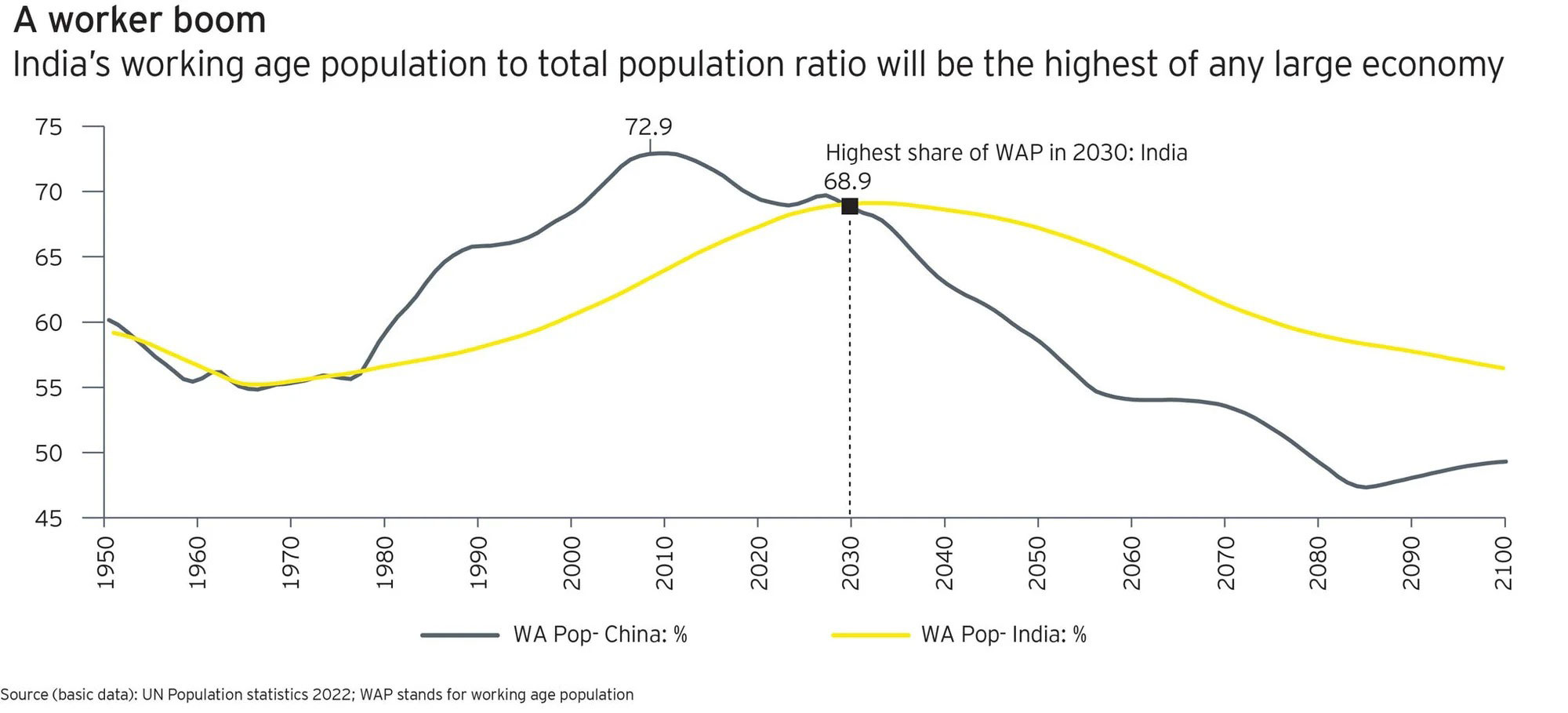

India’s Demographic Dividend – A Catalyst For Growth

This insight highlights India’s significant demographic dividend, projecting its working-age population to peak at 68.9% by 2030, accompanied by its lowest dependency ratio. With a median age of 28.4 years, India possesses a competitive workforce advantage and immense consumption power. The nation is set to contribute nearly a quarter of the global incremental workforce, bolstered by a large pool of STEM graduates. This powerful demographic trend, combined with increasing private consumption and a burgeoning consumer credit ecosystem, is poised to drive substantial economic growth and global human resource supply.

Source: www.ey.com

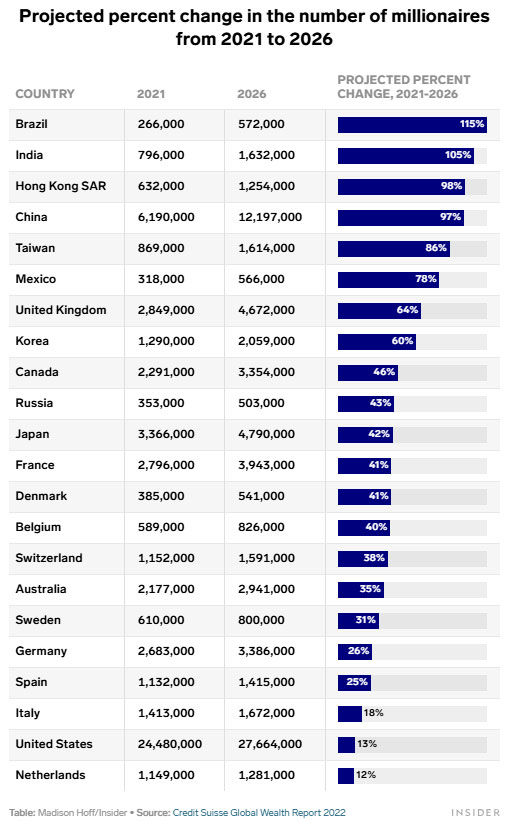

Wealth Trends Unveiled

Global Wealth Forecast – Emerging Markets Drive Millionaire Growth

This insight, based on projections by Credit Suisse, forecasts a significant global surge in millionaires, reaching over 87 million by 2026—a 40% increase from 2021. This growth is primarily driven by inflation and rising asset values. Notably, India and Brazil are projected to lead this global trend, each seeing their millionaire populations more than double (over 100% increase) in the coming years. While the U.S. currently holds the largest number of millionaires, its growth rate is expected to be more modest (13%), highlighting a notable shift in the global wealth landscape towards dynamic emerging economies.

Source: www.businessinsider.com

Shaping India’s Financial Future

India’s Accelerating Wealth Boom & Shifting HNWI Landscape

This insight, drawing on the Capgemini World Wealth Report 2025 and expert commentary, highlights India’s accelerating wealth creation, positioning it as a rapidly emerging hub for billionaires, with its High-Net-Worth Individual (HNWI) population and collective wealth outpacing global peers and China in 2024. A profound generational wealth transfer is significantly reshaping wealth management preferences, driving strong demand for advanced digital services and personalized offerings among India’s younger HNWIs. Furthermore, a substantial majority of next-gen HNWIs plan to significantly increase their offshore investments by 2030, seeking better investment options, superior services, enhanced market access, and favorable tax environments, signaling a dynamic evolution in global wealth management needs.

Source: www.businesstoday.in

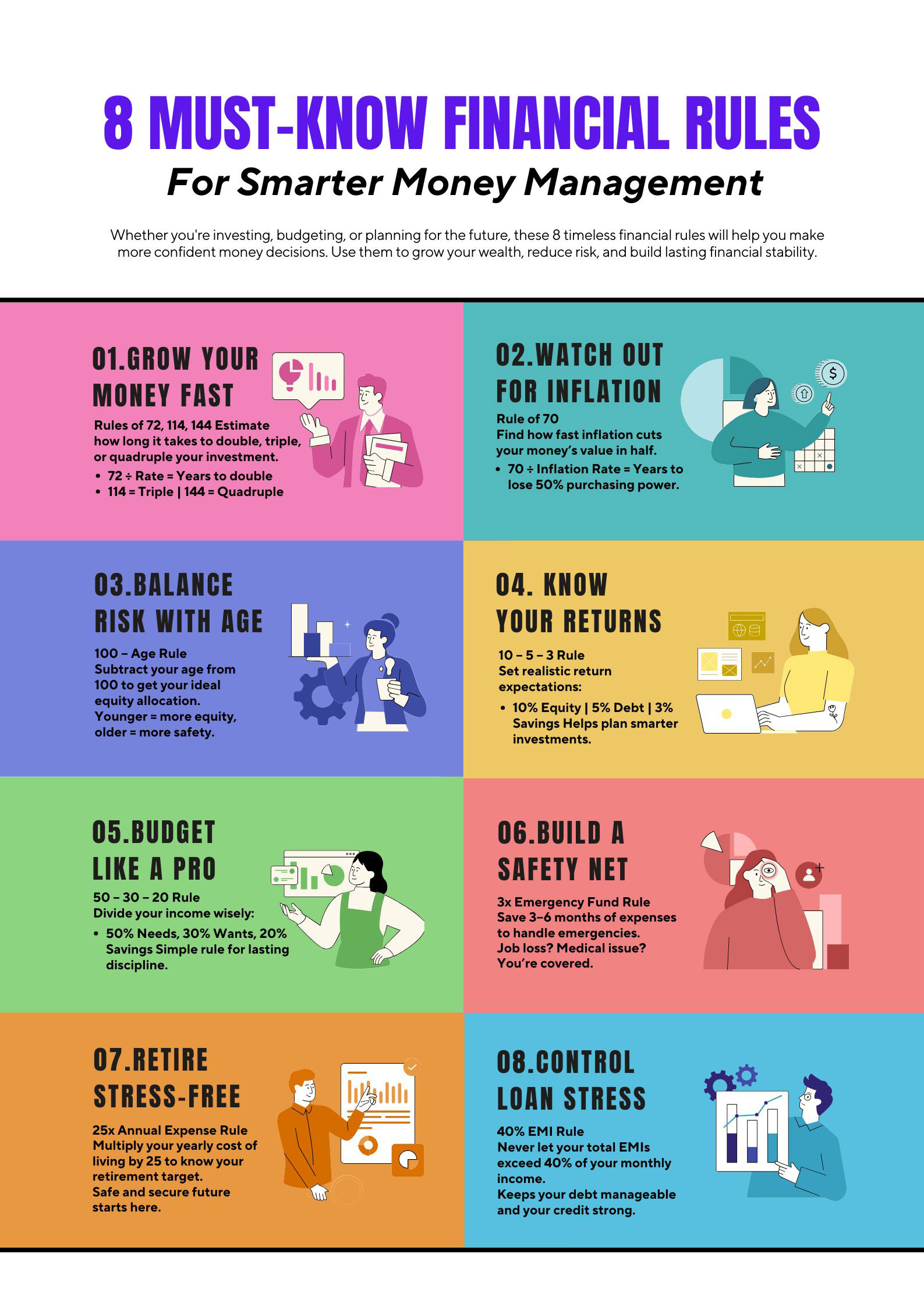

Investment Wisdom at a Glance

Visualizing

Core Investment Principles

Simplify complex investing with our curated infographics. These visually engaging guides distill essential market rules—from compounding and strategic asset allocation to crucial risk management—into clear, actionable knowledge. Strengthen your financial literacy, reinforce best practices, and make confident, well-informed decisions for sustainable wealth growth.

Unlock Your Financial Future

Elevate Your Market Understanding

Gain an unparalleled edge with our exclusive paid newsletter. Access in-depth market analysis, strategic forecasts, and actionable intelligence delivered directly to your inbox.

Strategic Financial Partnership

Ready to discuss your unique financial situation and explore tailored strategies? Our expert advisors are here to provide personalized guidance, helping you navigate complexities and achieve your financial aspirations.

Get In Touch

Contact Us Today

+91 9810185185

dkinvestments63@gmail.com

90, Gagan Vihar Main, Vikas Marg, New Delhi, 110051